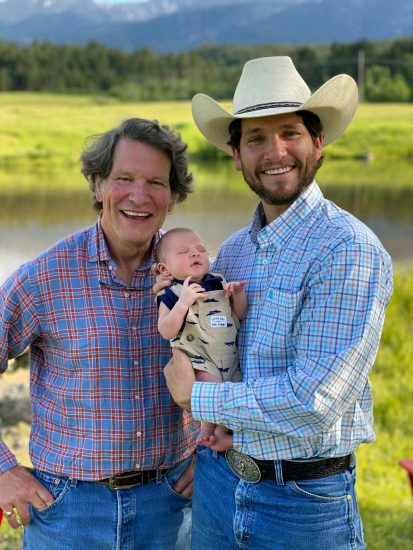

What Legacy Will You Leave?

Legacy philanthropy is much more than sending a check. It ensures your continuing support for causes you care about. It gives you the opportunity to carry on a family-giving legacy. Combined with careful estate planning, it ensures that your personal resources are used to accomplish your financial and charitable goals. By establishing a fund with the Community Foundation, you receive:

- Permanence: The Community Foundation’s trusteeship ensures that your contribution will continually meet needs relevant to your interests.

- Commemoration: Your name or the name of a loved one can live on through your fund. If you prefer, you may choose a name that reflects your fund’s charitable purpose.

- Stewardship: The Foundation’s Board of Directors, with guidance from its Investment Committee, staff, and outside investment counsel, closely monitors the performance of professional investment managers. The Foundation makes a full accounting to the community through its annual report, audit, and IRS Form 990.

- Grantmaking Expertise: The Community Foundation expertly assists in identifying charitable organizations and programs that address your particular interests and core values.

The Community Foundation primarily holds endowed funds in trust.

We also manage some provisional funds:

- Endowed Funds are allowed up to a 5% grant payout for perpetuity, to assure that grant funds are always available to help nonprofits.

- Quasi-Endowed Funds are allowed up to a 20% grant payout, which means the principal will be diminished over time.

- Provisional Funds can be paid out in full at any time.

Types of Funds

Community Grant Funds

- Fund for Chester County: Enable the Grants Committee to award strategic grants to Chester County nonprofits.

- Lincoln Building Fund: Support the renovation and repair of the Foundation’s historic 1833 headquarters.

- Operating Endowment: Allow the Foundation to focus on its core mission, growing legacy philanthropy throughout the region.

- Field of Interest Funds: Donors who seek to impact a targeted issue area (arts, education, environment, health, human service, religion) or specific geographic region establish Field of Interest Funds. By naming an interest area rather than a specific organization, flexibility exists to meet ever-evolving community needs.

Donor Advised Funds

Donor Advised Funds

An alternative to a private foundation, Donor Advised Funds are popular with donors who wish to establish a foundation without incurring administrative operating and compliance filing burdens, while capitalizing on the Community Foundation’s philanthropy expertise and nonprofit field research. Donor Advised Funds enable individuals, families, community groups, and businesses to focus their philanthropy and make grants that impact the causes they care about most.

Organizational Endowment & Nonprofit-Designated Funds

Designated Funds are created by nonprofit organizations and individual donors who care about the long-term success of particular nonprofit charities. This lets donors support specific charitable organizations for perpetuity, while the Community Foundation manages investments professionally and monitors for accountability.

Scholarship Funds

Establishing a Scholarship Fund allows the donor to support students pursuing education beyond high school. A donor may name the scholarship’s selection committee and the guidelines for candidate selection. Most scholarships at the Community Foundation benefit disadvantaged, promising students from a particular high school, or those who pursue a particular field of study.

Memorial Funds

Donors can quickly and cost-effectively create commemorative funds honoring people they hold dear.